Great Boulder Resources Extends High-Grade Gold Discovery at Ironbark

Konrad Forrest

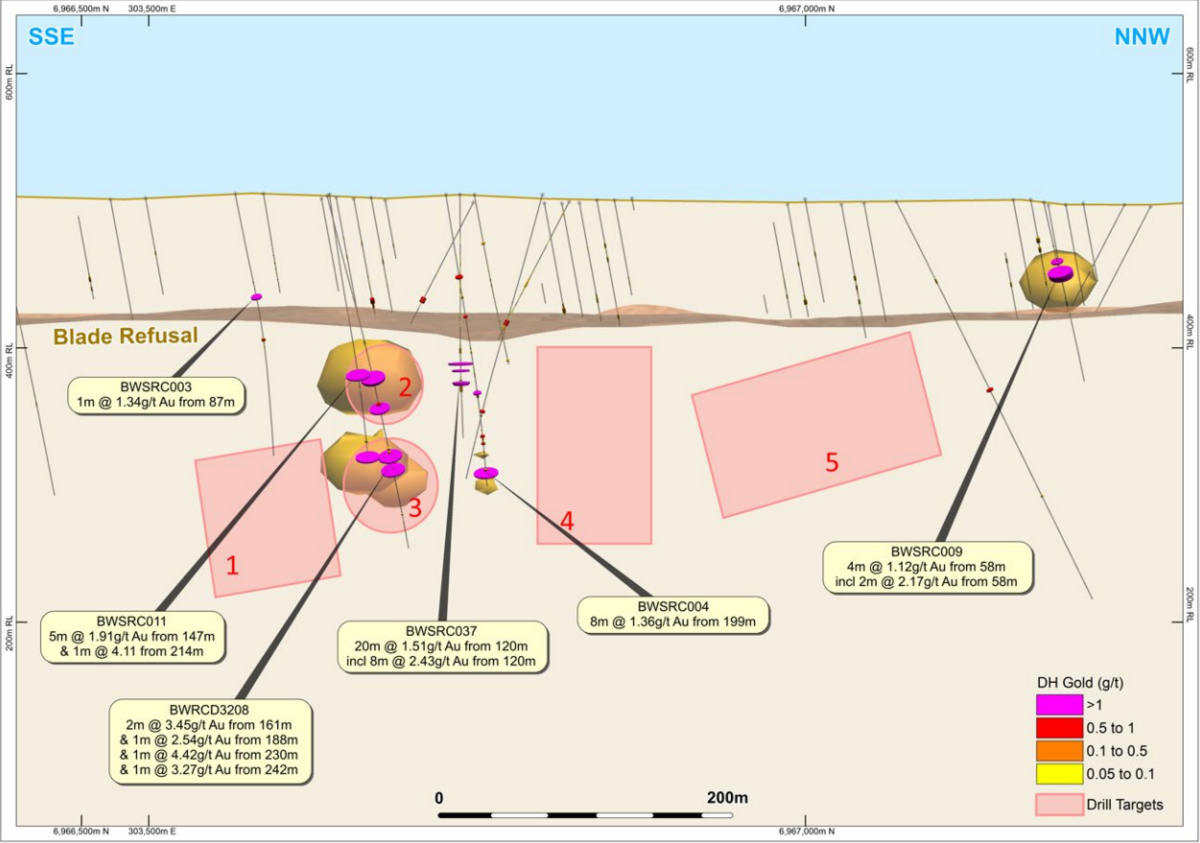

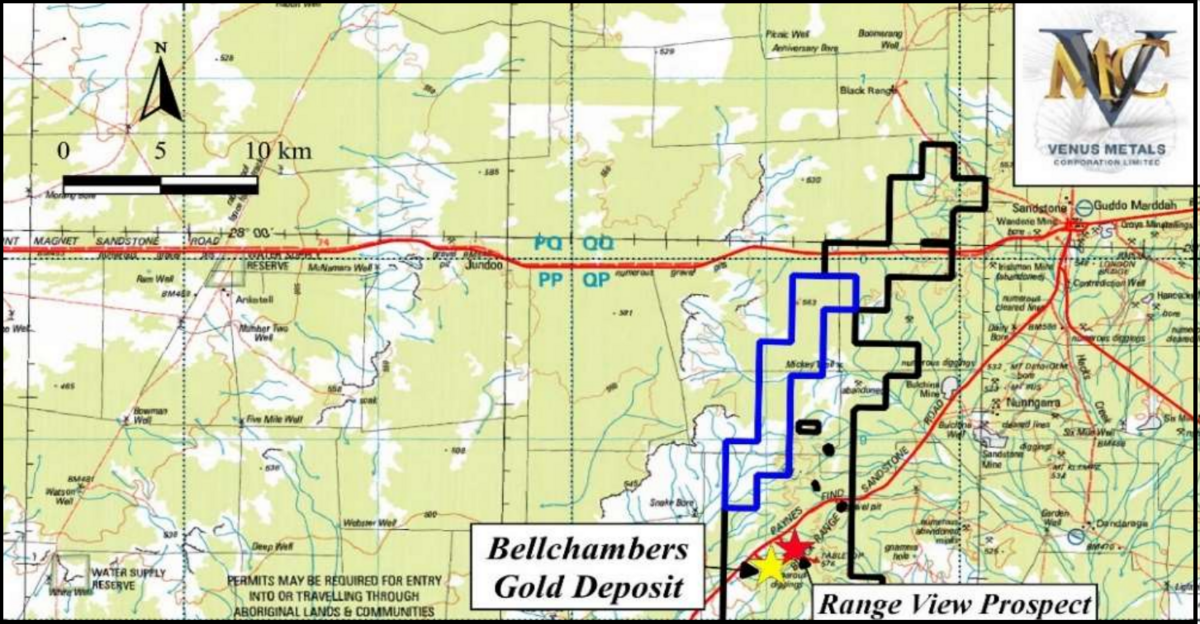

Great Boulder Resources Limited (ASX: GBR) has announced significant high-grade gold intersections at the Ironbark gold deposit, part of the Side Well Gold Project near Meekatharra in Western Australia, extending known mineralisation to the south.

Key Highlights:

-

Recent RC drilling at Ironbark intersected shallow, high-grade gold mineralisation, including:

-

8m at 9.07g/t gold from 113m, including 5m at 13.84g/t gold.

-

-

This intersection extends mineralisation 60 metres south of the current resource boundary, suggesting further potential beneath existing shallow drilling approximately 170 metres further south.

-

Additional RC drilling is ongoing at Side Well South, building upon earlier promising gold intercepts.

-

The Ironbark scoping study is advancing well, with results expected this quarter.

Managing Director Andrew Paterson commented, "These results confirm the southern extent of Ironbark remains open, reinforcing our confidence in the potential for significant resource growth. Our ongoing exploration continues to deliver exciting results, supporting our strategy for further drilling."

Follow-up drilling is planned to further define and potentially expand this high-grade zone, with expectations of continued resource enhancement.

For further details, visit www.greatboulder.com.au.