Regis posts strong FY25 result; dividend reinstated as underground growth advances

Konrad Forrest

22 August 2025 | Perth, WA – Regis Resources (ASX:RRL) has delivered a sharply improved FY25 result on the back of higher gold prices and resilient operations, reporting $1.65bn revenue (+30%) and a $254m NPAT turnaround from last year’s loss. The Board has reinstated dividends with a fully franked 5c final dividend payable 6 October 2025 (record date 11 September 2025).

FY25 highlights

-

Gold production: 373koz, near the top end of guidance; AISC $2,531/oz.

-

EBITDA: $780m (+163% YoY); operating cash flow $821m (+73% YoY).

-

Balance sheet: $517m cash & bullion at 30 June; debt repaid and unhedged; new $300m RCF in place.

-

Safety & ESG: LTIFR 0.4; 61MW hybrid renewables completed at Tropicana.

Operations & growth

-

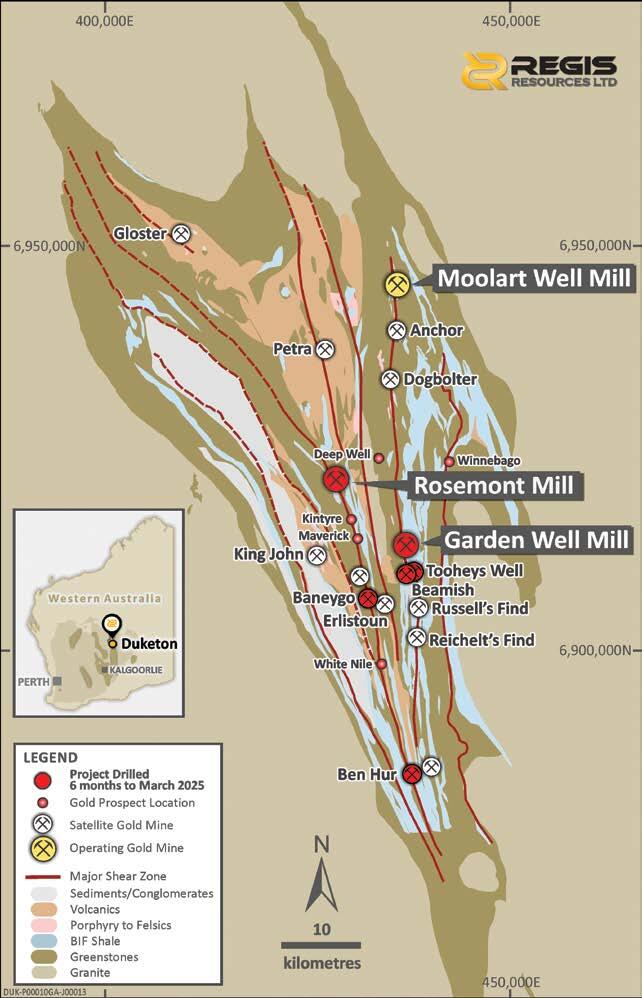

Duketon (WA): Continued push to at least four underground mines, with Garden Well Main and Rosemont Stage 3 on track for first production in FY26; open-pit reserves at Duketon lifted to 640koz.

-

Tropicana (30% JV): FY25 production 140koz (Regis share), AISC $2,039/oz; Havana Underground development progresses toward H2 FY27.

McPhillamys update (NSW)

Following the Commonwealth Section 10 cultural heritage declaration over part of the approved project area in FY24, Regis has withdrawn the McPhillamys DFS outcomes and 1.89Moz of Ore Reserves and commenced Federal Court proceedings while assessing alternative project configurations.

Comment

With a debt-free, unhedged balance sheet and advancing underground pipeline, Regis says it is positioned to grow long-life, high-margin ounces from Tier-1 jurisdictions while maintaining returns to shareholders.