Arika starts 5,000m RC program at Pennyweight Point to extend high-grade lodes and test new IP targets

Konrad Forrest

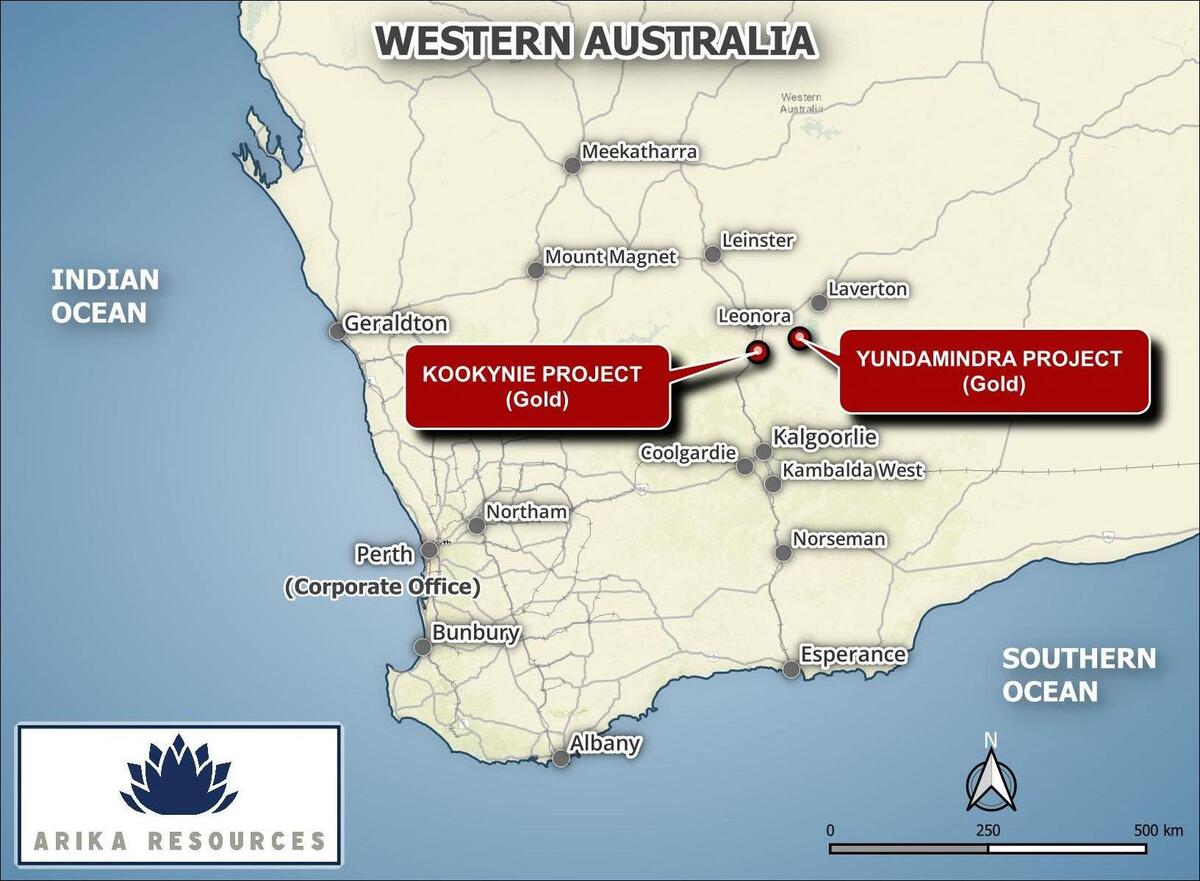

27 October 2025 | Leonora–Laverton, WA – Arika Resources (ASX: ARI) has commenced an approximately 5,000m RC drilling program at the Pennyweight Point prospect within the Yundamindra Gold Project (ARI 80%; NME 20%). The campaign is designed to extend known mineralisation and test newly defined ‘blind’ bedrock targets highlighted by recent geophysical work.

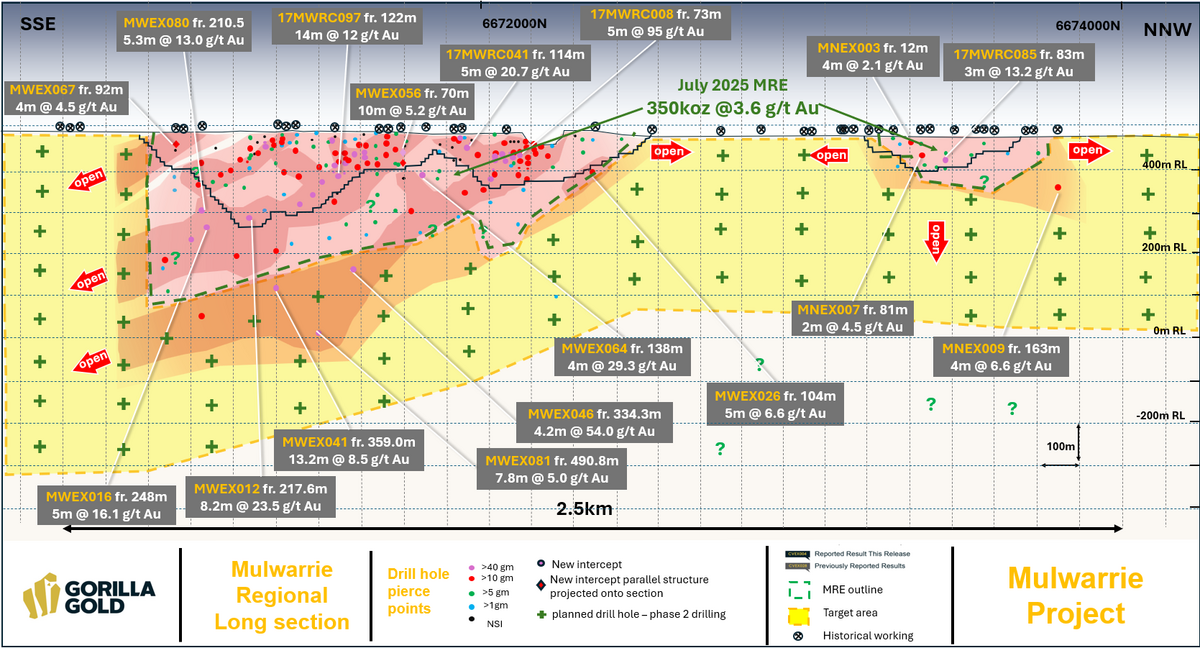

- Extending high-grade zones: Initial holes will follow up standout results including 35.76m @ 2.14g/t Au from 104.27m (incl. 13.46m @ 5.28g/t), 23.97m @ 2.54g/t Au from 162.03m (incl. 5.38m @ 10.62g/t), 14m @ 15.48g/t Au from 46m, and 30m @ 3.86g/t Au from 64m.

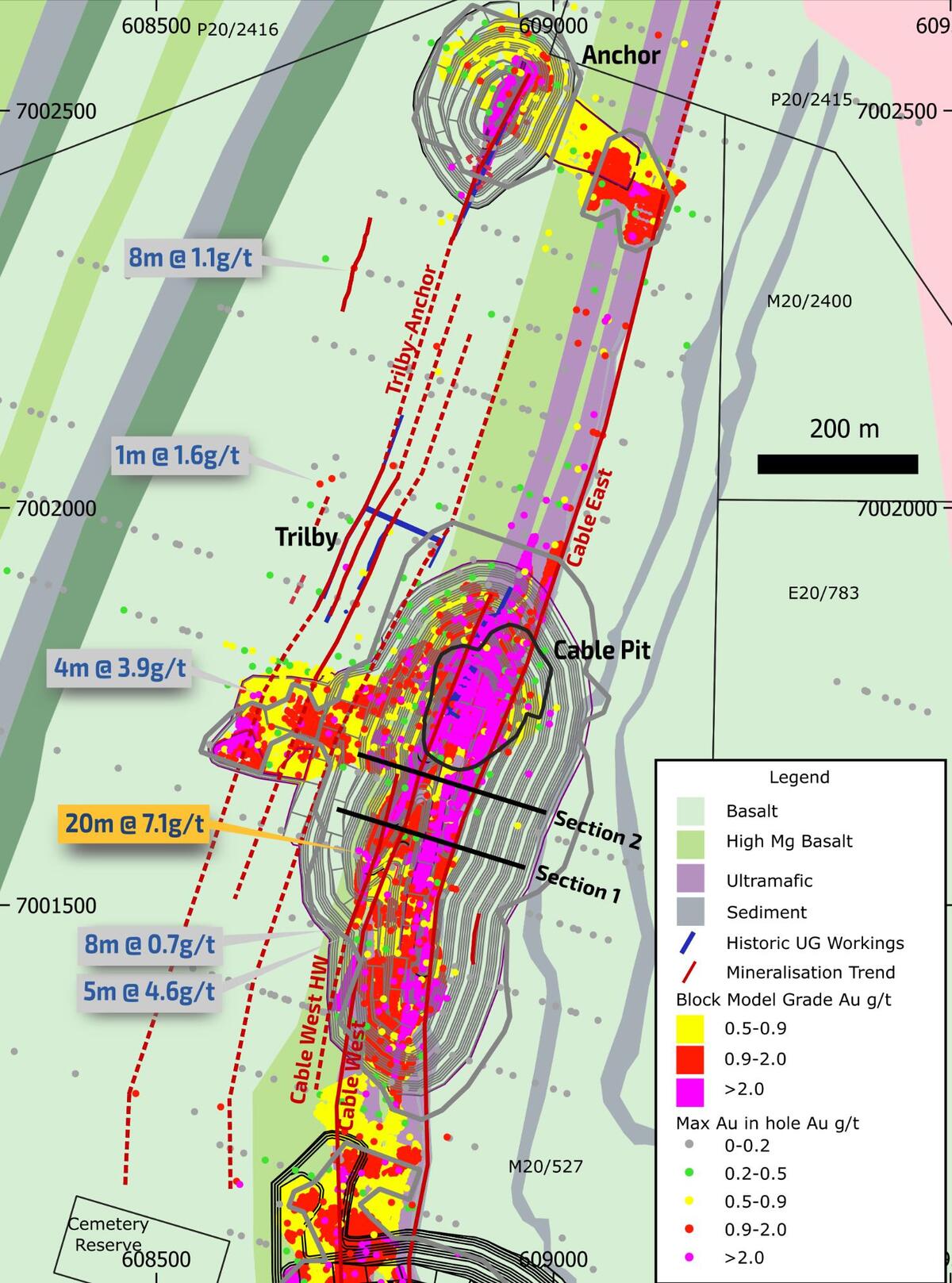

- New IP targets: Recent Induced Polarisation surveys refined priority anomalies north and south of Pennyweight Point, mapping the tonalite–mafic contact and subtle chargeability responses interpreted as sulphide alteration halos—potential vectors to additional lodes.

- Pathway to a maiden Resource: A third phase of close-spaced definition drilling is planned to support a maiden Mineral Resource estimate.

Pennyweight Point hosts a wide, high-grade orogenic lode system within tonalite (granite) along a sheared contact with mafic volcanics (basalt). Mineralisation strikes NE, dips moderately SE and plunges south, with drilling to date defining ~350m of strike to ~150m vertical depth—open in all directions.

Managing Director Justin Barton said: “We’re pleased to have the rig back at Pennyweight Point, our highest-rated and most advanced prospect at Yundamindra. The recent geophysical programs have significantly advanced our understanding of the ore-hosting structures and the best places to find extensions of the known high-grade mineralisation. Pennyweight Point, alongside Landed at Last, is shaping as a primary focus for initial resource development, and this ~5,000m program combines near-resource definition with step-out drilling and first-pass tests of compelling new bedrock targets immediately along strike.”

What’s next

• Ongoing RC drilling at Pennyweight Point, with results released as received and interpreted

• Integration of IP, magnetics and gravity to prioritise further step-outs

• Continued target generation across Yundamindra, including Yellow Brick Road and corridor prospects