Yandal Expands Siona Discovery Ahead of Major Aircore Drilling Push

Konrad Forrest

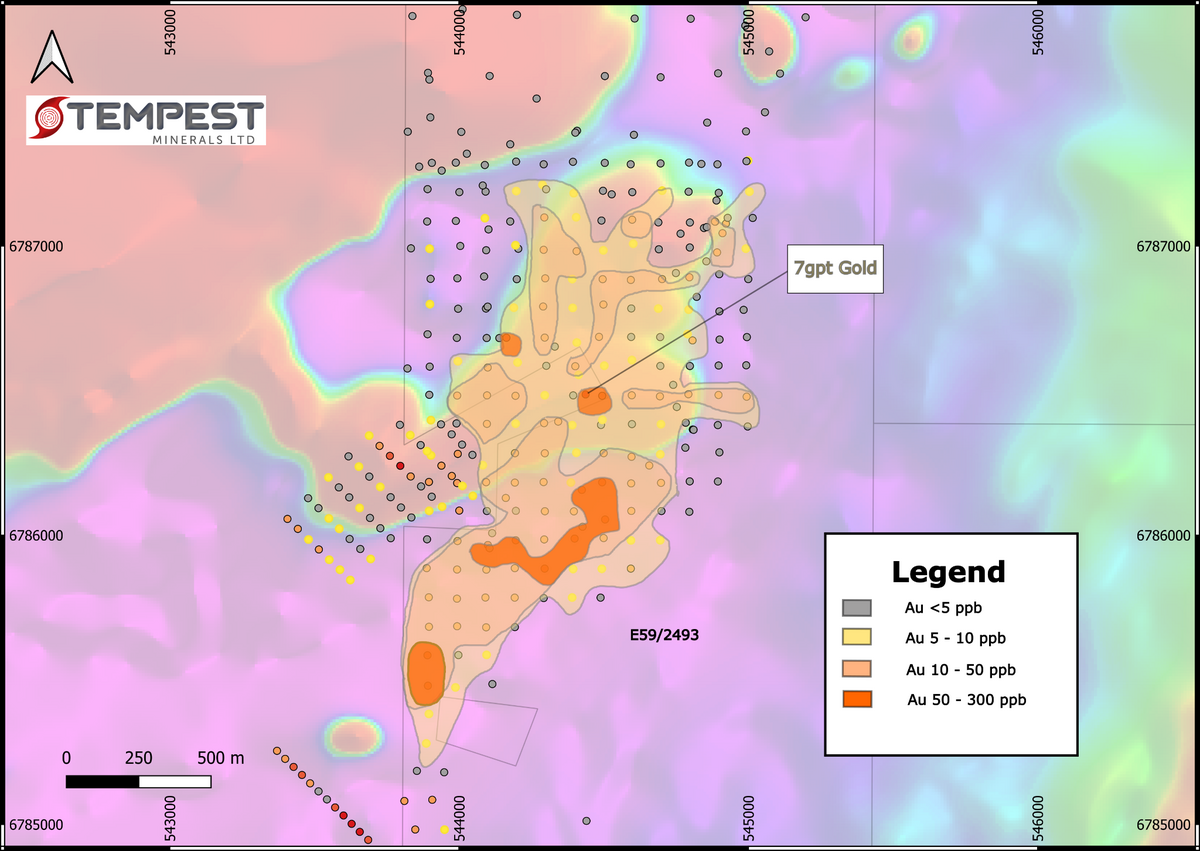

21 May 2025 | West Perth, WA – Yandal Resources (ASX:YRL) has confirmed broad zones of gold mineralisation at the Siona Discovery, part of its Ironstone Well-Barwidgee Project in WA’s northern Goldfields, and is now preparing to launch a major 12,500m aircore drilling program at the nearby Caladan prospect.

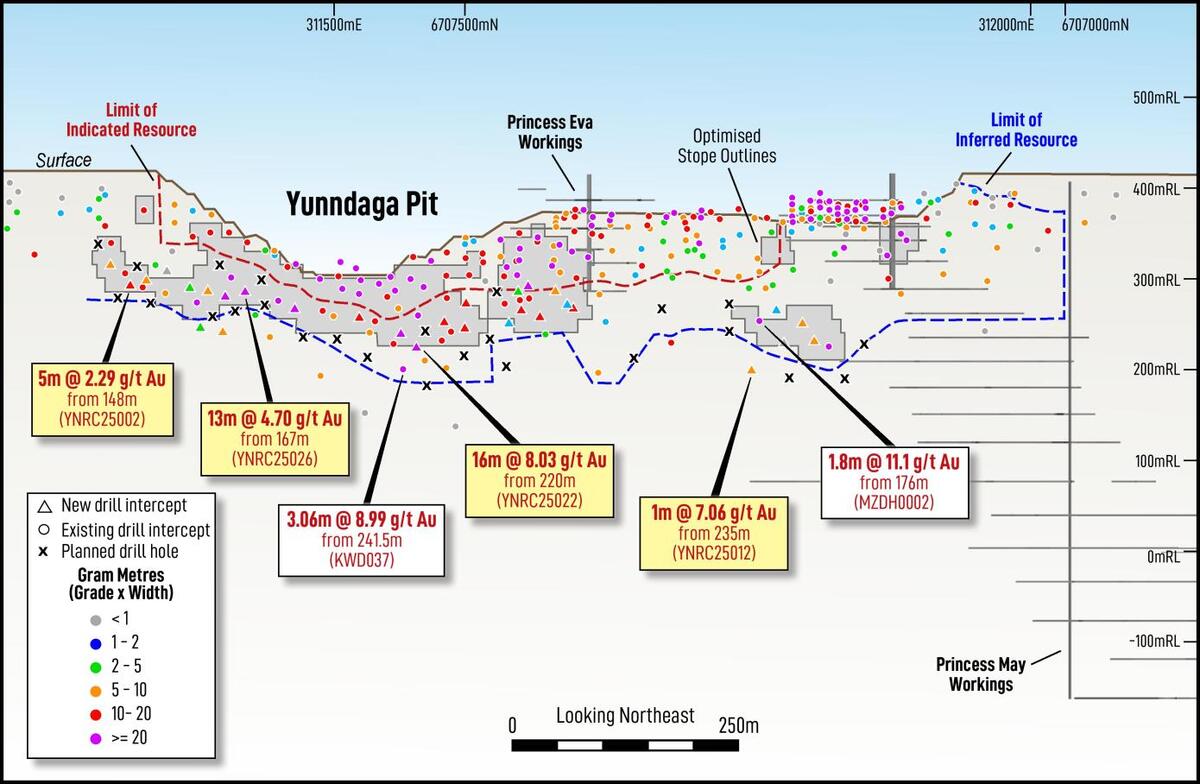

Diamond drilling at Siona returned:

-

16.3m @ 0.5g/t Au from 322.2m (25IWBRD0003)

-

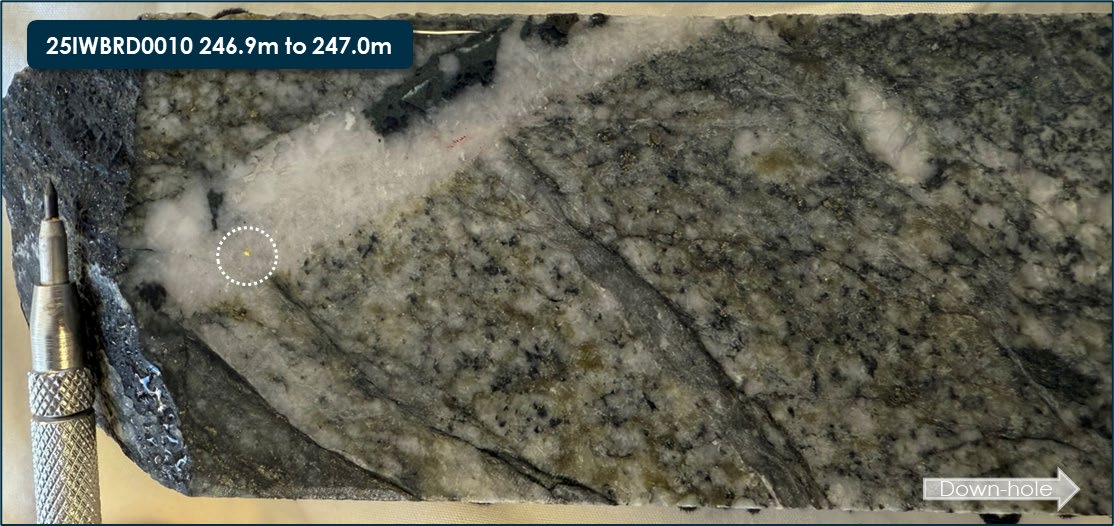

29.1m @ 0.4g/t Au from 282.9m (25IWBRD0010)

-

6.4m @ 1.5g/t Au from 103.5m, including

-

0.4m @ 12.7g/t Au (25IWBDD0009)

-

-

116m @ 1.0g/t Au from 97m (24IWBRD0039 – RC + diamond tail)

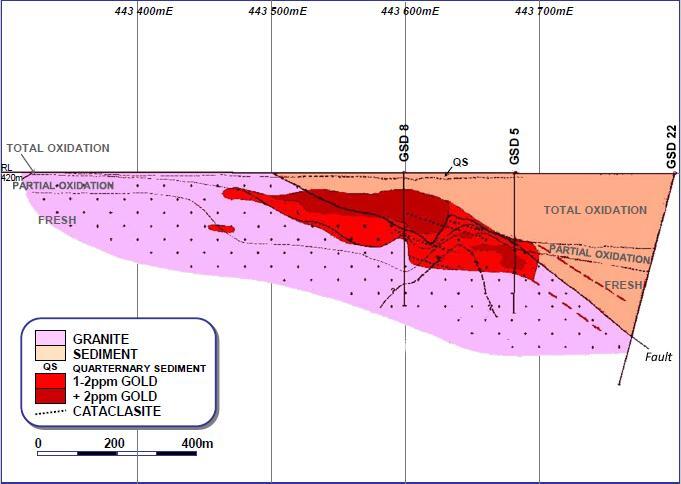

These results build on the broad, low-grade halo with internal high-grade zones identified in earlier RC drilling. Geological modelling suggests gold mineralisation is controlled by deformation along and within the New England Granite intrusion.

Managing Director Chris Oorschot said:

“We’re now armed with a much clearer understanding of the Siona system. With the full extent of the granite under Yandal’s control, we’re shifting focus to testing new structural targets that could deliver larger-scale discoveries.”

Next steps:

-

Caladan aircore drilling begins late May

-

Follow-up aircore at Salusa and other New England Granite (NEG) targets

-

Heritage surveys scheduled for late May / early June

-

RC drilling to resume post-aircore to test deeper high-grade trends at Siona

Yandal sees the NEG as a regional-scale gold system, with visible gold, strong alteration, and favourable structural controls now confirmed through diamond drilling.