Ausgold Hits Broad Gold Zones Across Key Regional Prospects

Konrad Forrest

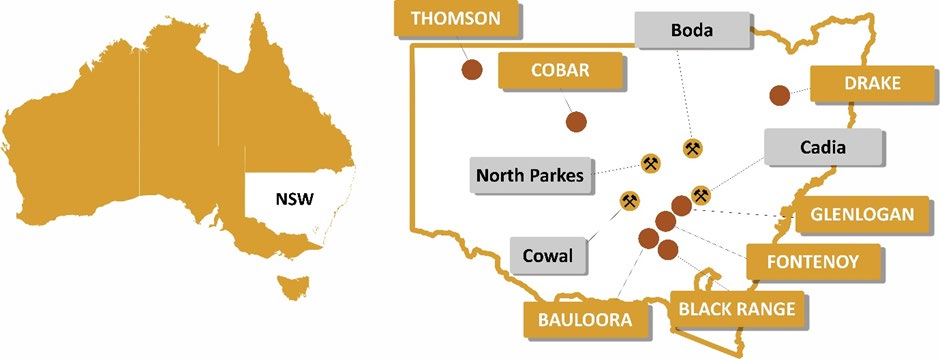

14 May 2025 | Perth, WA – Ausgold Limited (ASX:AUC) has reported strong gold intercepts across multiple regional prospects within its 100%-owned Katanning Gold Project (KGP) in Western Australia, bolstering the company’s growing pipeline of potential satellite deposits.

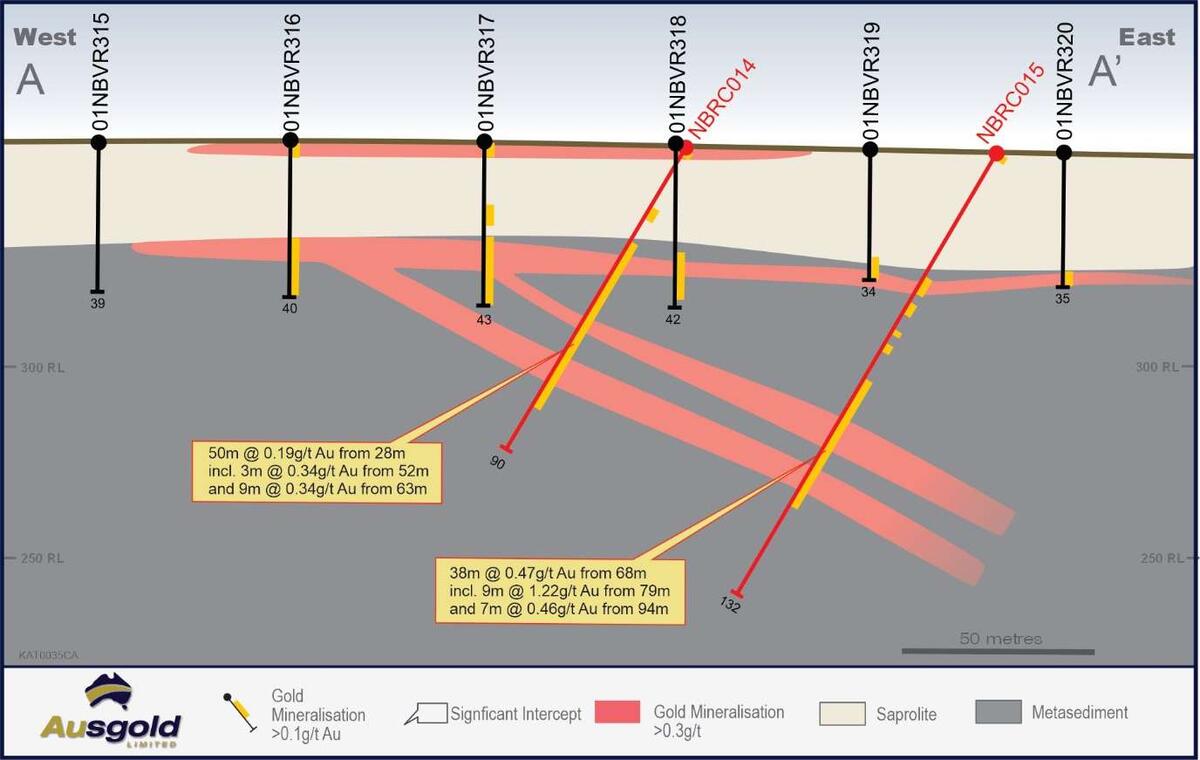

The latest results come from a 32-hole RC drilling campaign totalling over 4,300m, targeting four regional prospects along the Stanley Thrust: Zinger, Stanley Hill, Moulyinning and McDougalls.

Highlights from Zinger include:

-

10m @ 4.75g/t Au from 23m, incl. 2m @ 23.20g/t Au (NBRC011)

-

51m @ 0.37g/t Au from 17m (NBRC016)

-

38m @ 0.47g/t Au from 68m, incl. 9m @ 1.22g/t Au (NBRC015)

Other notable intercepts:

-

Stanley Hill: 11m @ 0.42g/t Au and 5m @ 0.65g/t Au (up to 2.95g/t)

-

Moulyinning: 6m @ 0.51g/t Au, incl. 1m @ 2.57g/t Au

-

McDougalls: 17m @ 0.22g/t Au from 30m and 5m @ 0.41g/t Au from 82m

Executive Chairman John Dorward said:

“This drilling is the final piece of our exploration strategy, confirming the potential for a significant gold district around Katanning. These regional prospects could underpin a network of satellite deposits that enhance the scale and optionality of the broader KGP.”

The results support Ausgold’s three-pronged campaign strategy: de-risking early-stage mining zones at KGP, adding resources, and discovering new gold systems across the 3,500km² tenement package.

Ongoing diamond drilling at Datatine in the Northern Zone is expected to deliver further high-grade results later this quarter.