Pantoro Confirms Wide, High-Grade Gold Zones at Scotia

Carol Forrest

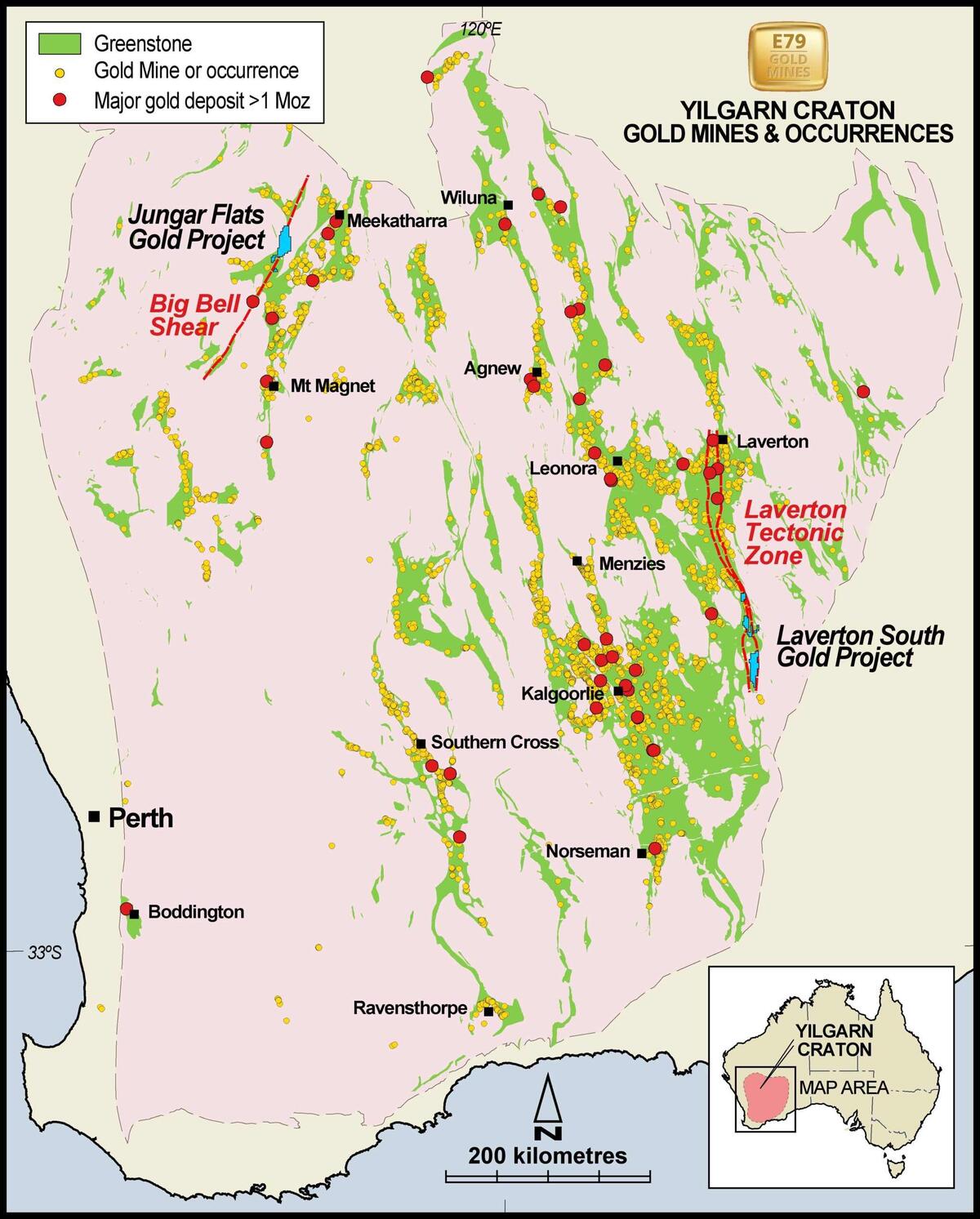

Pantoro Limited (ASX: PNR) has reported significant high-grade gold intersections at the Scotia Mining Centre, part of the company's 100%-owned Norseman Gold Project in Western Australia. The latest grade control drilling results and ore development activities indicate further resource expansion potential beyond the current Ore Reserve.

Key Highlights:

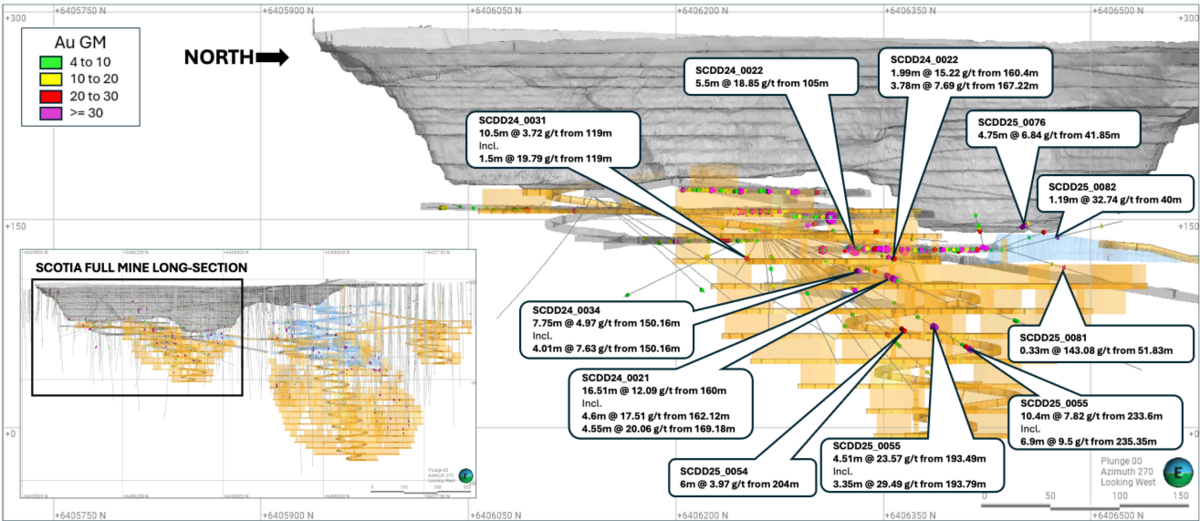

- 83 new grade control holes completed, confirming wide, high-grade gold mineralisation.

- Exceptional drill results, including:

- 16.51m @ 12.09 g/t Au, including 4.6m @ 17.51 g/t Au and 4.55m @ 20.06 g/t Au

- 10.4m @ 7.82 g/t Au, including 6.90m @ 9.5 g/t Au

- 5.50m @ 18.85 g/t Au

- 4.51m @ 23.57 g/t Au, including 3.35m @ 29.49 g/t Au

- 0.33m @ 143.08 g/t Au

- Development confirms additional mineralisation outside the current Ore Reserve, potentially expanding the mine plan.

Scotia on Track for Production Ramp-Up

Pantoro’s Managing Director, Paul Cmrlec, emphasised the strong growth potential at Scotia:

"Scotia continues to demonstrate its potential as a long-life, large-scale underground mine. We are transitioning from a development-driven operation to full-scale production, with steady-state mining targeted by the end of March 2025."

The company is ramping up production with stope drilling underway to build adequate drilled stocks for upcoming mining phases. A fourth development jumbo is set to arrive on-site in early March to accelerate underground access development.

Strategic Growth Plans

- Extensional exploration to continue as underground drilling platforms become available.

- Ongoing surface and underground drilling to further define and expand the Scotia deposit.

- Infrastructure upgrades to support higher production capacity, aiming to exceed 200,000 ounces per annum across Norseman.

With the latest drilling results confirming the high-grade nature and continuity of mineralisation, Pantoro is positioning Scotia as a cornerstone asset in its long-term growth strategy.