Catalyst Metals Begins First Ore Production at Plutonic East, Expanding Plutonic Gold Belt

Carol Forrest

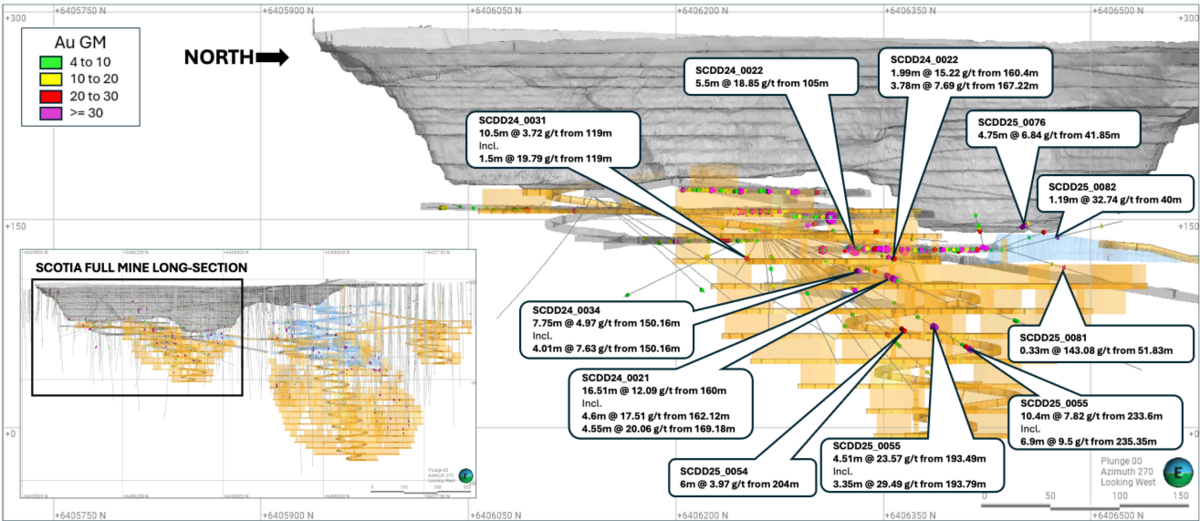

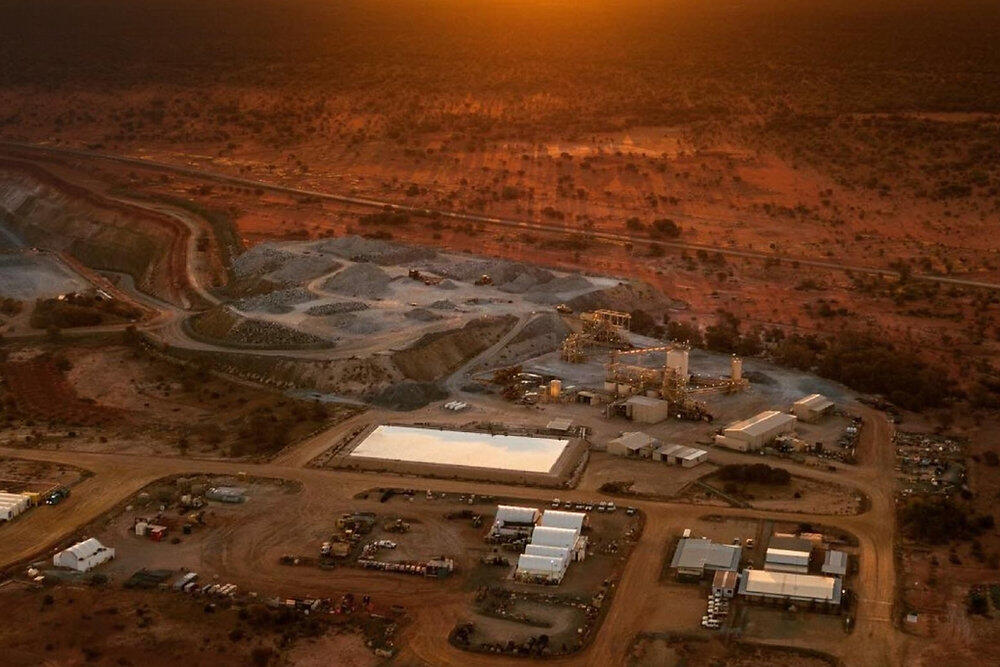

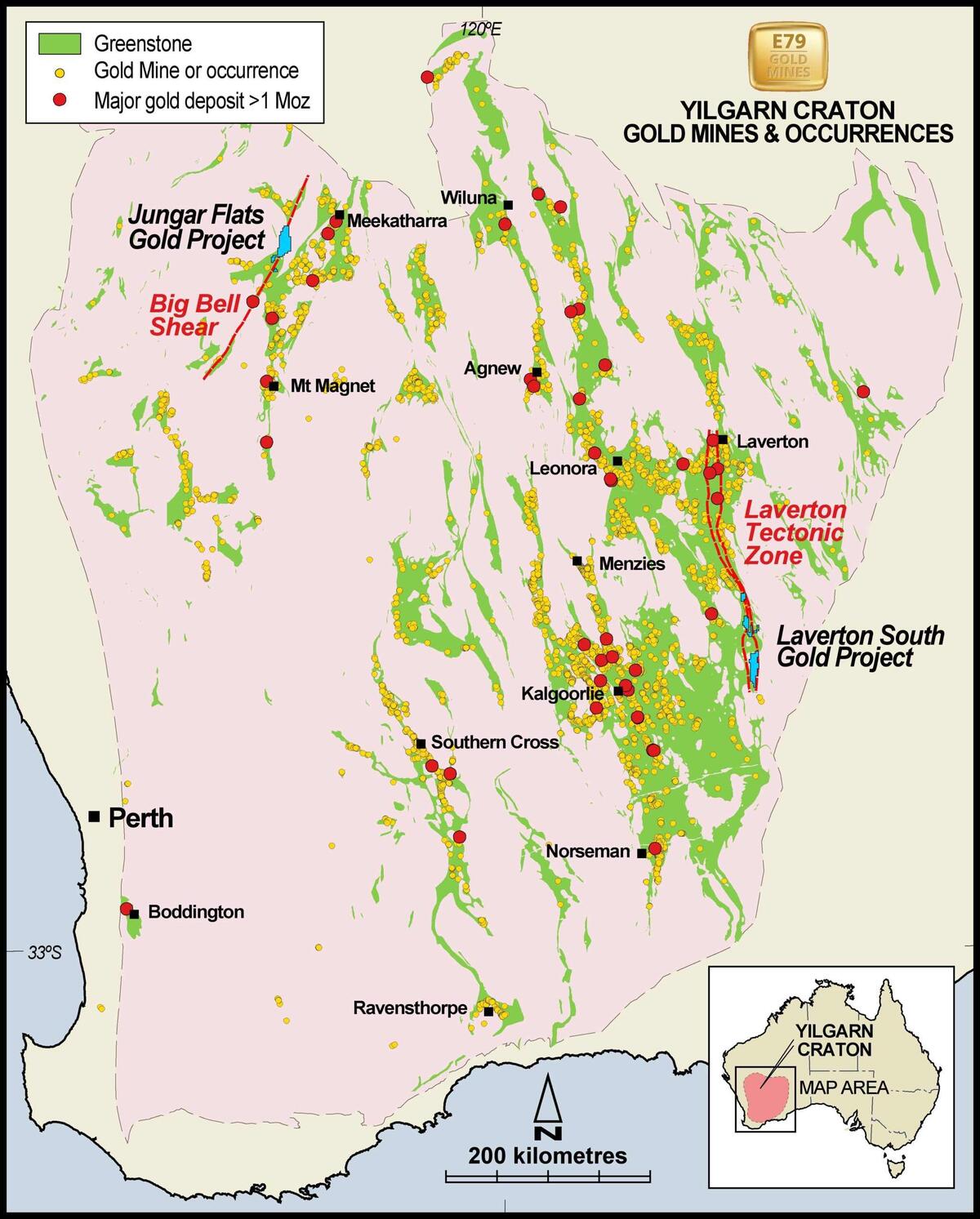

Catalyst Metals Limited (ASX: CYL) has commenced first stoping ore production at its Plutonic East underground mine, marking a significant step in the company’s strategy to expand production across the Plutonic Gold Belt in Western Australia.

Key Highlights:

✅ First Ore Mined at Plutonic East

- Plutonic East is a pre-existing underground mine, last mined by Barrick Gold in 2012 at ~A$1,500/oz gold prices.

- Ore will be processed through the currently underutilised Plutonic processing plant, enhancing operational efficiency.

- Plutonic East is expected to lower operational risk by diversifying ore sources beyond the main Plutonic underground mine.

✅ Plutonic Gold Belt Growth Strategy

- Plutonic East is the first of three new mining areas planned for development over the next 12-18 months.

- Catalyst aims to double production to 200,000oz per year at a capital cost of just A$31 million.

- Next developments: K2 and Trident mines, following the successful ramp-up of Plutonic East.

✅ Major Production Milestone for Catalyst Metals

- 110,000oz annual gold production across Plutonic and Henty mines.

- 3.4Moz total Mineral Resource, with 1.0Moz Ore Reserve.

- Cash & Bullion: A$84 million, with zero debt, providing strong financial backing for expansion.

Strategic Outlook

Catalyst’s Managing Director & CEO, James Champion de Crespigny, commented:

"Plutonic East coming online is a transformational step in our growth strategy. It gives us more ore sources, lowers operational risk, and demonstrates our ability to develop the Plutonic Gold Belt into a long-life, multi-mine operation."

With a well-funded development plan, expanding ore sources, and a scalable processing plant, Catalyst Metals is well-positioned for sustained gold production growth in Western Australia.

For more details, visit www.catalystmetals.com.au.