Mamba signs Exploration & Prospecting Agreement with Yugunga-Nya PBC to underpin Meeka East work programs

Konrad Forrest

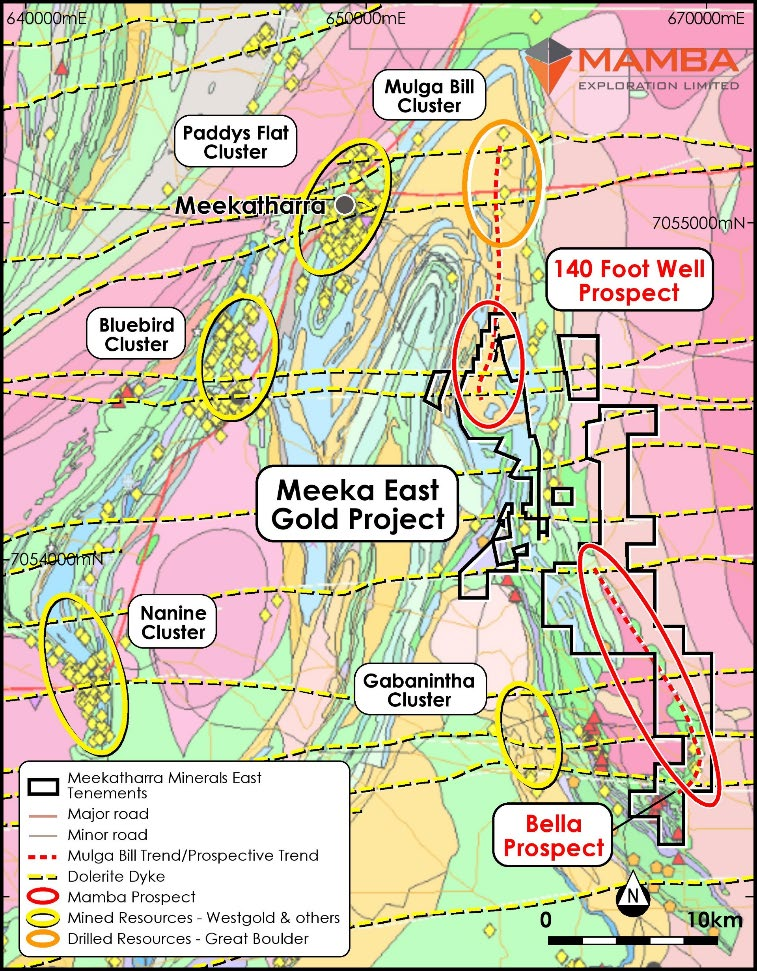

13 February 2026 | Subiaco, WA – Mamba Exploration (ASX: M24) has executed an Exploration & Prospecting Agreement with the Yugunga-Nya Native Title Aboriginal Corporation (RNTBC), establishing clear processes for heritage surveys, Aboriginal Site protection and ongoing cultural engagement across the Meeka East Gold Project area. The agreement provides a cooperative framework covering all 39 tenements within Meeka East, setting out communications protocols, cultural heritage management and site-protection measures to ensure activities are conducted in line with the Aboriginal Heritage Act and the Native Title Act. It was entered into with the authority of the registered tenement holders for the project.

Why it matters: The agreement supports Mamba’s planned exploration linked to its conditional acquisition of a 70% interest in Meeka East, streamlining approvals and survey pathways and enhancing long-term cooperation within the Yugunga-Nya Determination Area.

Management comment: Executive Director Matt Freedman said the agreement “establishes the foundations for a respectful and collaborative working relationship and ensures that future exploration is carried out in a culturally appropriate and responsible manner,” adding that Mamba looks forward to building a long-term partnership with the Yugunga-Nya People as programs progress.

Next steps:

• Meeka East – additional soil sampling along the Mulga Bill trend extension (potential >6km strike) and infill sampling at the northern project area; Bella Prospect sampling over priority areas.

• Ashburton Project – field reconnaissance over ~580km² across E08/2913 and E08/3343, ~190km south of Onslow and ~220km north-east of Carnarvon (WA).