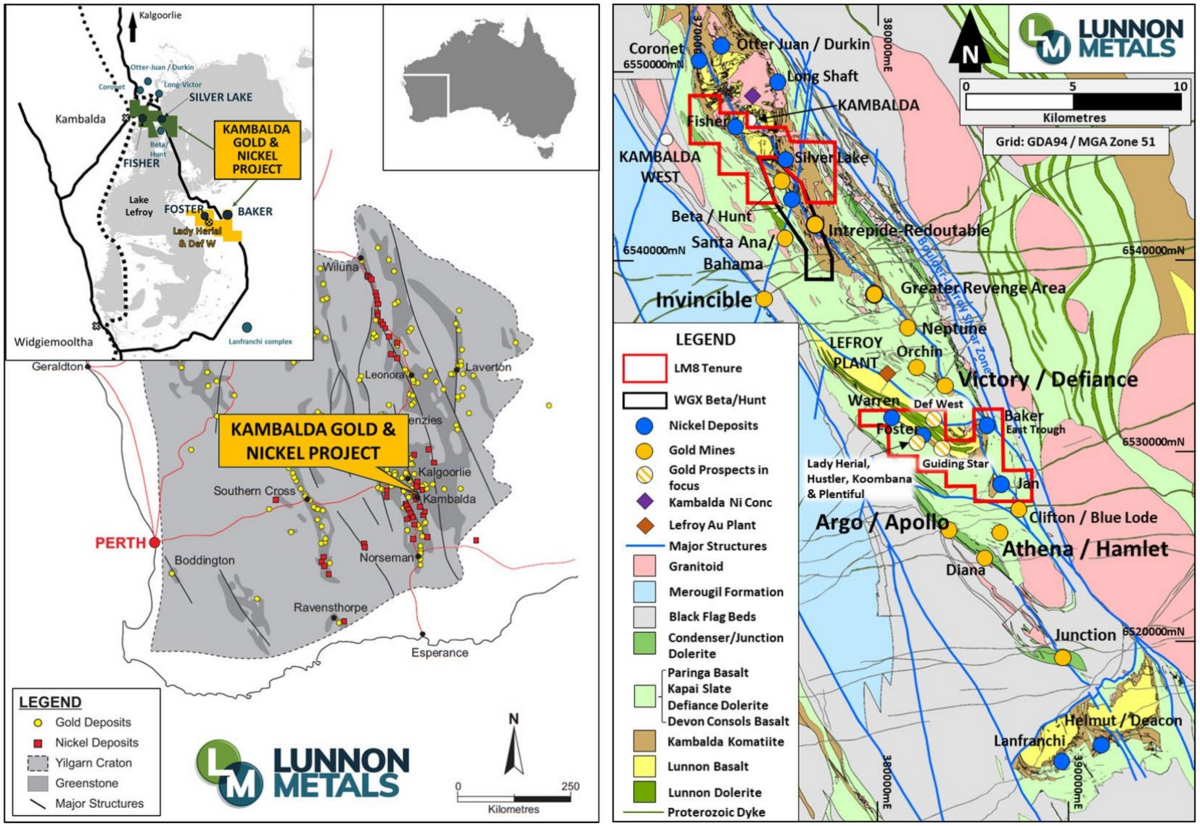

Lunnon Metals Hits Shallow Nickel at Baker and Confirms System Continuity

Konrad Forrest

11 June 2025 | West Perth, WA – Lunnon Metals (ASX: LM8) has intersected shallow, high-grade nickel sulphides in its first underground drilling at the Baker deposit, part of the Kambalda Nickel Project in WA. The results confirm system continuity and provide a strong platform for future mine planning.

Key results from the new underground program include:

-

3.72m @ 3.68% Ni from 23.5m

-

0.76m @ 6.21% Ni from 29.2m

-

1.01m @ 4.38% Ni from 35.0m

These are the first-ever drill intercepts from underground at Baker, validating the geological model and confirming mineralisation starts within 25m of the decline.

In addition, surface drilling at East Baker has returned:

-

6.45m @ 2.79% Ni from 225.1m, including

-

2.05m @ 6.32% Ni from 225.1m

MD Ed Ainscough said:

“We are encouraged by these early underground hits and the potential extensions at East Baker. We’re now in a great position to refine the mining strategy as development progresses.”

Development of the Baker boxcut and decline began earlier this year. Lunnon continues to target first ore from Baker in 2025, supporting its vision to become the next operating nickel miner in Kambalda.