Australian Rare Earths Confirms Near-Surface Uranium at Overland Project

Carol Forrest

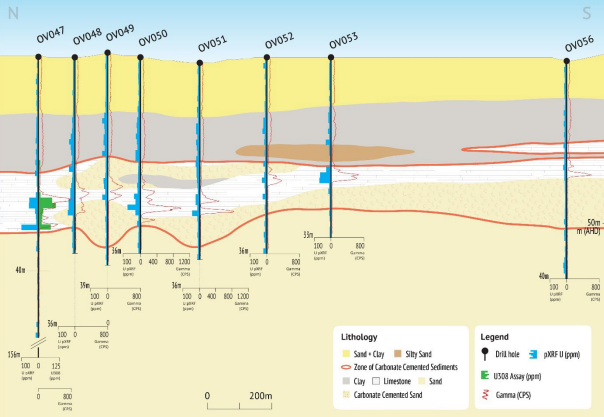

Australian Rare Earths Limited (ASX: AR3) has confirmed significant near-surface uranium intersections from assays at its Overland Project in South Australia, highlighting considerable potential for both shallow and deeper uranium deposits.

Key Highlights:

-

Assay results from drill hole OV047 confirmed:

-

2 metres at 92ppm U3O8 from 26 metres, including 1 metre at 103ppm U3O8.

-

Additional 1 metre intersection at 72ppm U3O8 from 31 metres.

-

-

Identified mineralisation at Overland suggests a promising anomalous zone up to 6 metres thick and over 1 kilometre wide, remaining open in all directions.

-

Dual potential for uranium confirmed: shallow calcrete-hosted deposits and deeper, ISR-amenable (in-situ recovery) deposits.

-

Ongoing drilling and assays expected to provide further insights, with additional results anticipated throughout the June quarter 2025.

Managing Director Travis Beinke remarked, “These assay results underscore Overland's significant potential, validating our exploration strategy. Our dual approach targets both near-surface and deeper ISR uranium deposits, positioning AR3 strongly within the uranium exploration space.”

Further exploration activities, including targeted follow-up drilling, will continue throughout 2025 to expand the identified mineralisation zones.

For further updates, visit www.ar3.com.au.