Evolution delivers record FY26 half-year result, lifts dividend and backs growth projects

Konrad Forrest

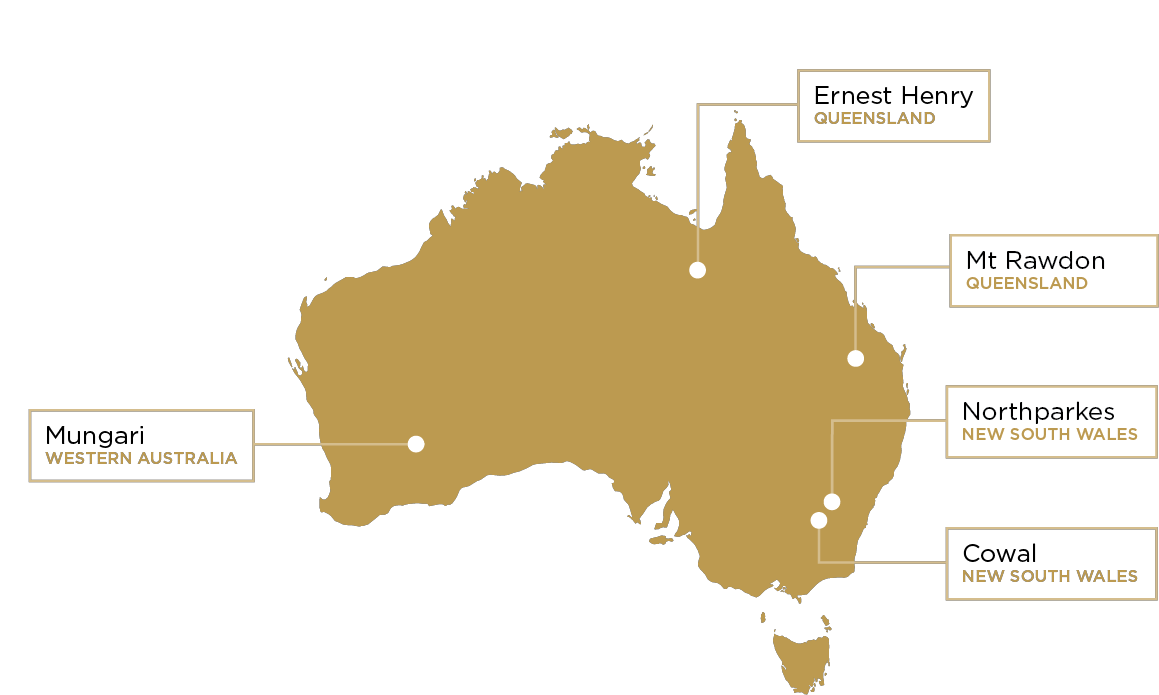

Evolution Mining has delivered a record FY26 half-year result (to 31 December 2025), supported by strong operational performance and metal prices. The company reported A$785 million underlying profit after tax, A$1.6 billion underlying EBITDA and A$608 million Group cash flow, with production of 365koz gold and 36kt copper.

Evolution also declared a fully franked interim dividend of 20 cents per share (record date 4 March 2026, payment 2 April 2026). The balance sheet continued to strengthen, with A$967 million cash, gearing of 6%, and all bank term loans repaid during the half year.

On the growth front, Evolution approved and progressed several key initiatives, including:

-

Northparkes: approval of the E22 block cave and Coarse Particle Flotation project

-

Ernest Henry: approval of the Bert deposit

-

Canada: expanded exploration footprint with Two Times Fred and an option over Clisbako

FY26 group guidance was reaffirmed at 710–780koz gold, 70–80kt copper and AISC of A$1,640–A$1,760/oz.

Comments from management

Management commentary: Evolution said the result reflects strong operational delivery and disciplined capital allocation, while continuing to invest in high-return growth projects to support long-term value and shareholder returns.