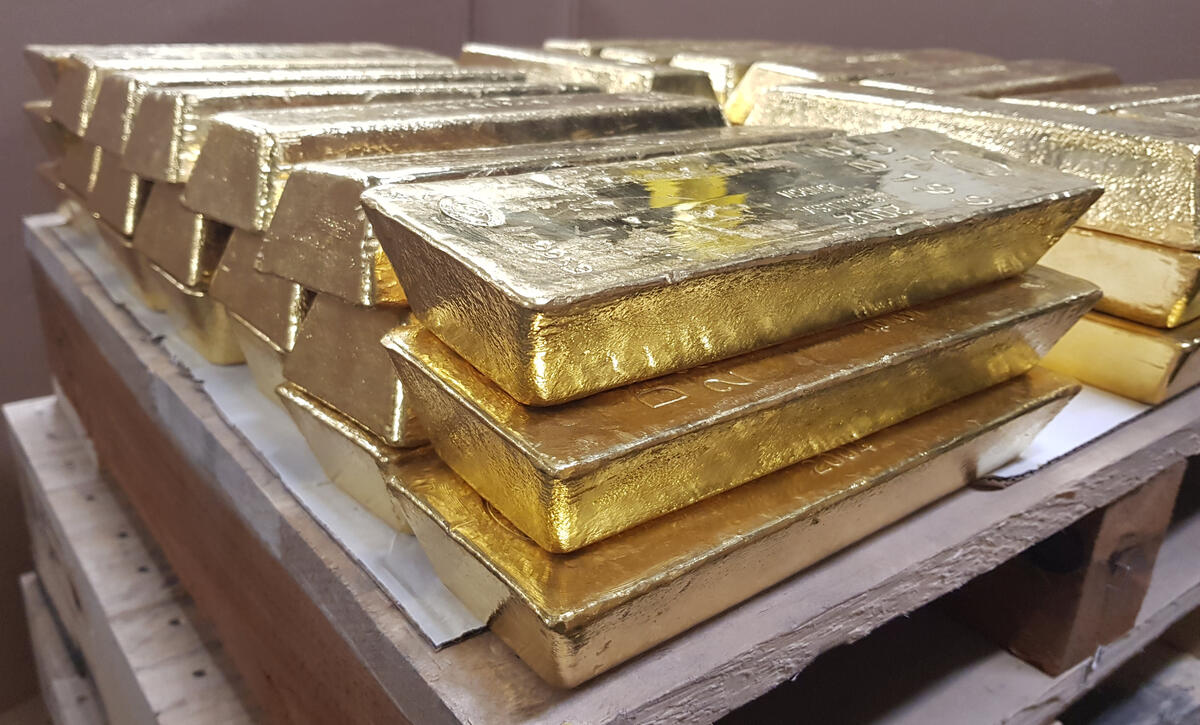

Gold and silver steady after sharp sell-off; rally cools but fundamentals remain supportive

Konrad Forrest

Perth, 22 October 2025 — Precious metals are attempting to find a floor after Tuesday’s sharp correction. Gold fell more than 5% from Monday’s record highs (near US$4,380/oz), closing around US$4,125/oz, while silver dropped about 8% to roughly US$48.5/oz. Early Wednesday trade has been choppy as prices consolidate in the wake of the move.

Analysts point to profit-taking after an overbought run, a firmer US dollar, and a modest improvement in risk appetite as key drivers of the pullback. Even so, gold remains significantly higher year-to-date in 2025, with silver also markedly stronger on the year.

What this means for WA miners and contractors

-

Budgets & plans: Despite volatility, elevated AUD-gold levels continue to underpin exploration and near-mine work programs across WA.

-

Hiring mix: We expect short-notice contractors (Exploration Geologists, Field Assistants, Core Yard, Drill & Blast support) to remain in demand as operators keep optionality while markets settle.

-

Rates & rosters: Contractor day rates are likely to remain firm; some clients may temporarily prioritise critical path roles and staged mobilisations.

-

Vendors & timelines: Expect a brief period of re-pricing and approvals checks rather than wholesale cancellations; strong asset margins at current levels still support activity.

Looking ahead

Markets will watch the US inflation print and the upcoming Fed decision for direction on yields and the USD—both important for bullion. A stable macro backdrop, ongoing central-bank interest and elevated geopolitical risk continue to provide medium-term support for gold.

If you’re planning campaigns or need immediate cover for rigs, mapping, data integrity or sampling, our team can mobilise WA-ready talent quickly across the Goldfields, Pilbara and Yilgarn.