Gold Production in Sight for Bellevue Gold

Tajha Pritchard

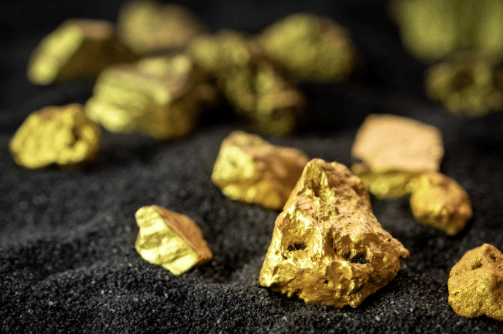

Bellevue Gold (ASX: BGL) has brought exciting news to investors, announcing the commencement of early cash flow generation at its flagship Western Australian (WA) gold project. The company is firmly on track to achieve its much-anticipated first production milestone, set for the December quarter of this year.

The successful transportation of the initial ore from the Vanguard open pit to Genesis Minerals' Gwalia plant for processing marks a significant step forward for Bellevue Gold. The company had previously established a toll treating agreement with Genesis, enabling ore processing at the Gwalia facility to generate early cash flow.

Progress on the ground has been remarkable, with the completion of the mill and gravity circuit's structural steel, along with the conveyor structure, paving the way for belt installation next week. Painting of the fine ore bin has also commenced, alongside other crucial activities such as mill shell section positioning, bolting, and mill bearing lube system fit-out initiation.

Bellevue Gold's gold project holds enormous potential, forecasting an annual production rate of 200,000 ounces of gold, with an estimated all-in sustaining cost of $1000 to $1100 per ounce. The mine's life of over 10 years and a resource estimate of 1.8 million ounces of gold add to the project's allure.

The company's successful progress towards production underscores Bellevue Gold's commitment to delivering value for its stakeholders while adhering to the highest industry standards in safety and environmental responsibility. As the project advances towards first production, Bellevue Gold's future looks increasingly promising in the competitive gold mining landscape.