Brightstar and Aurumin Consider Merger to Consolidate Sandstone Gold Project

Konrad Forrest

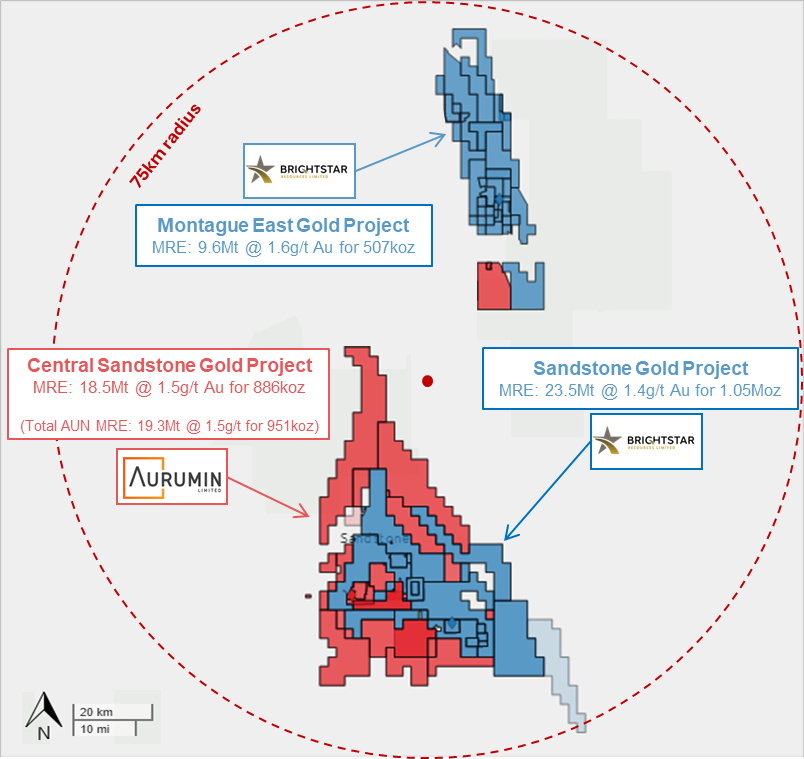

30 June 2025 | Perth, WA – Brightstar Resources (ASX:BTR) and Aurumin Limited (ASX:AUN) have entered into active merger discussions aimed at consolidating their tenement holdings in the Sandstone region of Western Australia into a single, large-scale gold project.

The proposed combination would merge the companies’ assets into a ~2.4Moz gold resource base, creating one of the most significant near-term gold development opportunities in WA’s Goldfields. The two boards have agreed on non-binding indicative terms for a scheme of arrangement under which Brightstar would acquire Aurumin for scrip consideration, offering 1 Brightstar share for every 4.6 Aurumin shares.

Based on Brightstar’s 20-day VWAP of $0.54 per share, the deal implies:

-

An Aurumin share value of $0.117,

-

A 17% premium to Aurumin’s 27 June 2025 closing price, and

-

A 26% premium to Aurumin’s 20-day VWAP.

Key potential benefits of the merger include:

✅ De-risking and accelerating the development of the consolidated Sandstone Gold Project

✅ Greater certainty for new regional infrastructure

✅ Unlocking exploration and operational synergies

The combined entity would control granted mining leases hosting major deposits such as Montague-Boulder, Whistler, Lord Nelson, and Two Mile Hill, positioning the Sandstone Gold Project as a standout regional opportunity.

The companies emphasised that the transaction remains subject to satisfactory mutual due diligence, execution of a scheme implementation deed, and other customary conditions. There is no certainty a transaction will proceed, and shareholders are advised no immediate action is required.

Both companies’ boards have approved the announcement and committed to updating shareholders on any material developments.