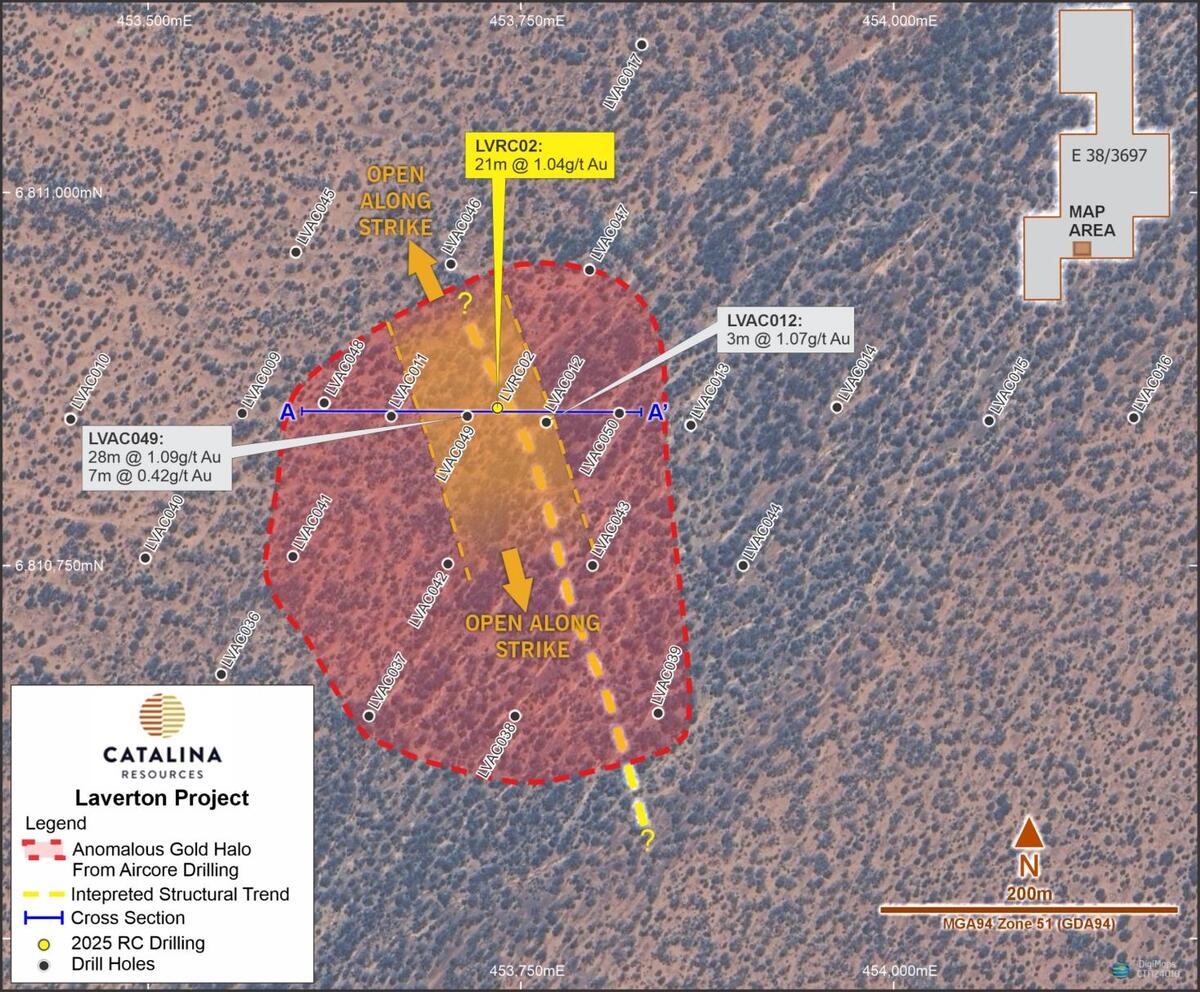

Catalina Resources Begins Drilling at Laverton Gold Project

Konrad Forrest

31 July 2025 | Perth, WA – Catalina Resources (ASX:CTN) has today announced the commencement of its maiden drilling campaign at the Laverton Gold Project, marking a significant milestone for the newly listed explorer.

The ~2,500m aircore program will target multiple gold and nickel anomalies across the Rum Punch and Whisky prospects, including:

-

A 5km gold-in-soil anomaly at Whisky, supported by historical RAB drilling

-

Magnetic signatures interpreted as ultramafic rocks with nickel sulphide potential

-

Structural trends near known gold workings within the Laverton tectonic zone

The campaign builds on historical data from Metex and other past operators, with Catalina aiming to verify previous intercepts and identify new mineralised systems.

Managing Director Daniel Smith commented:

“We’re excited to hit the ground running so soon after listing. Laverton sits in a proven gold district with untapped potential, and this program is the first step in unlocking value.”

Catalina listed on the ASX in May and is fully funded to pursue early-stage exploration across both Laverton and its Gascoyne lithium project, where fieldwork is expected to commence later this quarter.

With assays expected from the Laverton drilling in Q3, Catalina is rapidly progressing toward defining new gold and base metal targets in one of WA’s most prolific belts.