Fosterville delivers for NEWMARKET GOLD

(not verified)

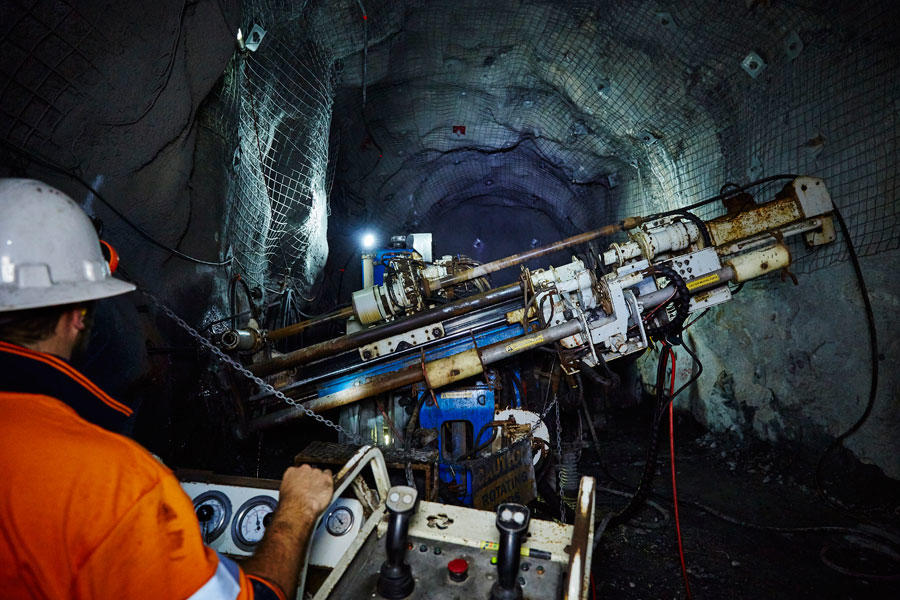

Canadian listed Newmarket Gold is the owner of 3 underground operating mines in Australia. The flagship operation, Fosterville Gold Mine, and the Stawell Gold Mine are located in the state of Victoria, and the Cosmo Gold Mine is located in the Northern Territory. Newmarket Gold produced 55,794 ounces during the third quarter and and has achieved record production of 175,041 ounces for the first nine months of 2016. Fosterville achieved third quarter production of 36,967 ounces, only 1% off the record performance achieved in Q2 2016, accounting for 66% of consolidated production. Cosmo achieved a record recovery rate of 95.3%, up from its record of 94.2% in the previous quarter, contributing 10,677 ounces of production during Q3 2016, with Stawell contributing 8,150 ounces.

Douglas Forster, President & CEO, Newmarket Gold said “Based on record consolidated production in the first nine months of 2016, Newmarket Gold is on track to meet the Company’s improved guidance of 225,000 - 235,000 ounces of gold as announced in Q2 2016. The business combination with Kirkland Lake Gold is expected to close during Q4, more than doubling 2016 pro-forma gold production to over 500,000 ounces from a new operating platform of 7 underground mines in Tier 1 mining jurisdictions. In addition, the combined company will generate superior free cash flow and have strong financial and technical capabilities to exploit its pipeline of exploration and development opportunities to fuel future organic growth. We believe the combined entity will be a preferred investment among mid-tier gold producers, commanding an increased capital market profile and enhanced shareholder value.”

“Newmarket Gold achieved record production of 175,041 ounces of gold for the first nine months of 2016, led by high grade, low cost ounces from our flagship Fosterville Mine which produced 107,350 ounces of gold with YTD AISC per ounce sold of $743. Productivity improvements at Fosterville were achieved through increased mine production utilizing new higher capacity haul trucks and the opening of new production levels in the Lower Phoenix area, as well as increased mill throughput rates, all of which contributed to favorable third quarter operating cash costs per ounce of $471 and an AISC per ounce sold of $765. Newmarket’s liquidity position continues to improve, supporting our overriding objective to grow free cash flow which totaled $11.9 million in Q3 2016 and $38.2 million YTD. Since the start of 2016, we have generated cash flow from operations of $74.7 million and ended the third quarter with $82.5 million in cash, a 126% increase from the start of the year.”